This is the next in a series of excerpts from my paper “Governance at a Crossroads.”

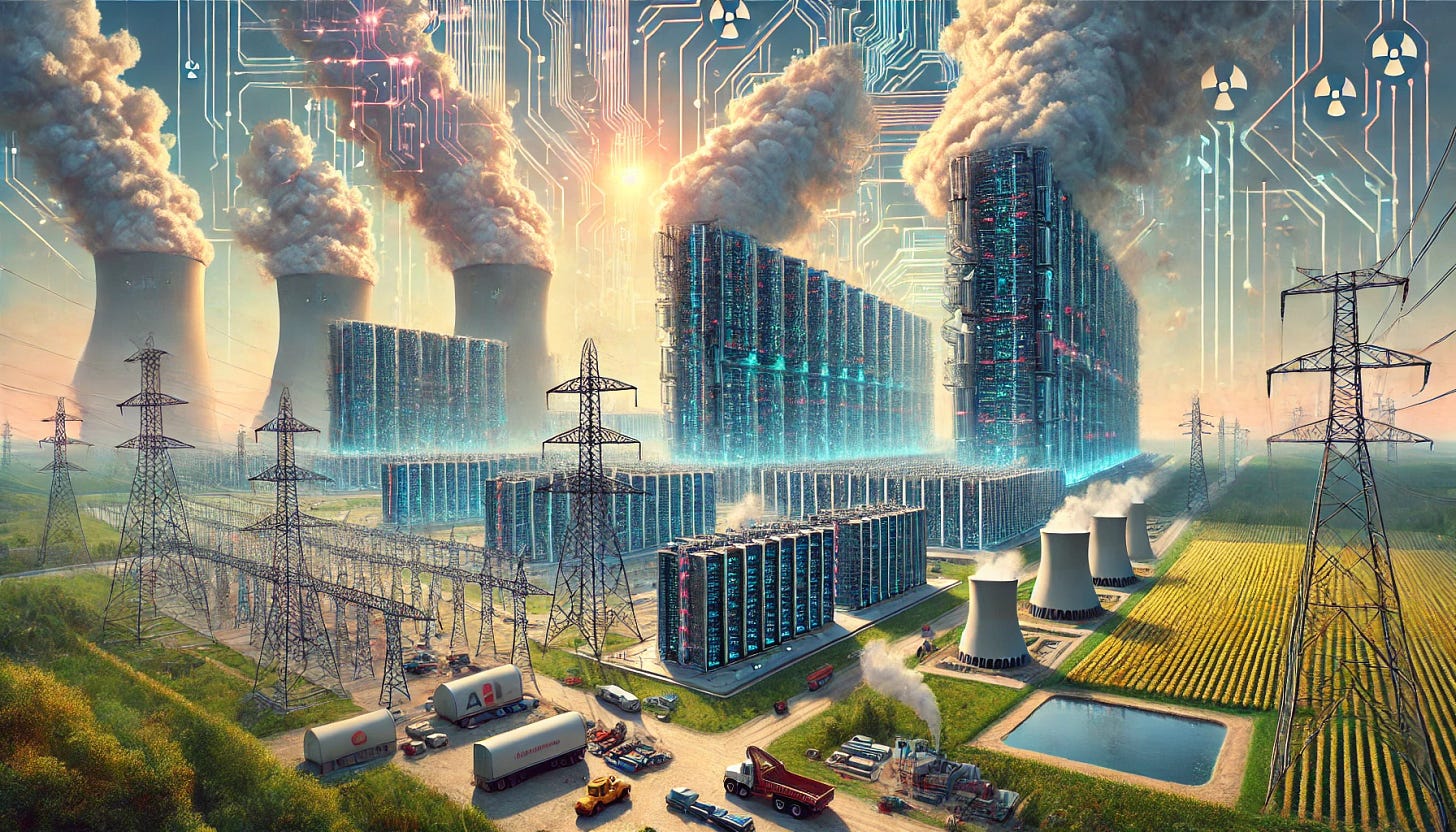

AI and its data center infrastructure are hungry for energy.

According to Goldman Sachs, data center power demand will surge to 8% of the U.S. total by 2030 from 3% in 2023, growing at a 15% CAGR (compound annual growth rate). For context, the total energy demand in the country has been flat in the decade up to 2022 and is now projected to accelerate at 2.4% CAGR, of which data centers represent 37.5% of the total growth. This pattern reflects an AI-driven growth in data center demand at the same time there is industrial reshoring and growth in manufacturing activity. About $50B in capital investment in U.S. power generation is required only to keep up with the data center growth until 2030. In another projection, the U.S. Department of Energy estimates that data centers will consume up to 12% of total U.S. electricity by 2028.

Big Tech is accelerating investments in AI data center buildout. Microsoft announced plans for a 2025 investment of $80B in data centers to train AI models and host the cloud infrastructure to deploy AI applications. While this represents a global investment, more than half will be made in the U.S. . OpenAI, together with Oracle, SoftBank, and the MGX Emirati investment firm, announced a $500B investment over four years to build AI infrastructure. The AI-driven data center boom is reshaping several U.S. regions. Northern Virginia’s “Data Center Alley” leads, consuming a quarter of the state's power load. Texas follows with rapid growth, while California remains crucial despite constraints. Washington state has emerged as a significant player, with data centers consuming 5.69% of its electricity in 2023. The state benefits from abundant renewable energy, with 54% of Central Washington’s data centers powered by hydroelectricity. However, this growth strains the power grid and challenges Washington’s green energy goals. Emerging secondary markets are being developed across the country, bringing a combination of economic benefits and infrastructure and environmental challenges as states balance growth with sustainability concerns.

The surge in demand is driving large enterprise consumers to reevaluate their energy-sourcing strategy. It has led to a resurgence of interest in nuclear power for reliable and emissions-free electricity. One technology, small modular reactors (SMR), has caught the attention of Big Tech. SMRs’ compact footprint allows them to be sited in locations unsuitable for larger nuclear plants. Their prefabricated units can be manufactured off-site, shipped, and installed efficiently, reducing costs and construction delays compared to custom-built large reactors. These smaller reactors can be deployed incrementally, aligning with growing energy demands while saving time and expense.

Amazon Web Services incorporated SMRs into their plans for net-zero carbon operations by 2040 and is signing agreements with utilities in Washington and Virginia to use this technology. In addition to exploring the usage of SMRs, Microsoft plans to reactivate the Three Mile Island nuclear power plant in Pennsylvania, the site of the worst nuclear reactor accident in U.S. history. Google is collaborating with the startup Kairos Power to develop and deploy SMRs. Their goal is to provide up to 500 megawatts of continuous carbon-free power by 2035 to support their AI energy demands while helping improve grid reliability and global decarbonization efforts.

In parallel, in an intense lobbying effort, OpenAI has proposed to the Biden and Trump administrations the development of massive data centers, each consuming as much power as an entire large city, to advance AI models and maintain U.S. competitiveness with China. The company argues that these facilities could generate tens of thousands of jobs and boost GDP if supported by the right governmental policies. The proposed 5-gigawatt data centers each represent the equivalent of five nuclear reactors and could power 3 million homes. Oklo, a U.S. nuclear power plant developer, has signed a non-binding agreement with data center operator Switch to deploy 12 gigawatts of projects based on their technology by 2044. Sam Altman, CEO of OpenAI and Chairman of Oklo’s Board of Directors since 2015, actively lobbied the White House for government support in the nuclear-powered data center buildout. This episode underscores the promise of public-private partnerships and policies to drive technology adoption while testing the boundaries of conflicts of interest when a single company dominates multiple aspects of the discussion.

The new facilities require repurposing historically agricultural land to develop large-scale data centers. Data centers rely heavily on water for cooling, often drawing hundreds of thousands of gallons per day and putting considerable pressure on natural resources. Orchards give way to high-tech hubs, disrupting local economies and cultures. The influx of wealth builds schools and infrastructure but raises living costs, pricing out many long-term residents. These dynamics impact the real estate market, with developers now seeking much larger land parcels, often 500 to 1000+ acres, compared to the 15–20-acre plots sought a decade ago. The scarcity of suitable sites with adequate infrastructure pushed development into secondary markets and rural areas. Developers are facing resistance from local communities concerned about the impact of large data centers on their areas, and some counties are considering bills to curb data center development. Land prices in key markets have tripled while asking rates for data center space have risen by 20% year-over-year in major North American markets.

Data center construction across the United States created a surge in demand for skilled electrical trade workers to build facilities and infrastructure. The current lead time to power new data centers in large markets such as Northern Virginia can be more than three years. And, in some cases, lead times for electrical equipment are two years or more. This escalating demand underscores the need for substantial investments in workforce development to ensure the availability of qualified labor essential for the timely and efficient expansion of data center infrastructure. Labor constitutes the backbone of AI’s ascent. Migrant electricians work long hours for lucrative pay while unions scramble to train new workers. Yet, once operational, these facilities offer minimal jobs, underscoring the short-term nature of such booms.

This second AI triad of energy, land, and labor reshapes economies and landscapes. Central Washington illustrates this transformation, where abundant hydropower fuels sprawling data centers vital for AI. Power drives the infrastructure as small towns become magnets for data-intensive operations. However, this reliance stretches the grid, forcing companies to seek nuclear solutions.

AI data centers’ increasing electrical power demand has a significant environmental impact. The training of GPT-3 by OpenAI used 1,287 megawatt-hours of electricity and produced 502 tons of CO2 emissions, the same power 120 average American homes consume in one year. Using LLMs for search is becoming the norm. Directly, with an app like Perplexity, using ChatGPT’s search feature, or relying on Google’s AI-generated search summaries. This new way of searching, at inference time, uses as much as ten times the energy a Google search does.

The new AI triad - energy, land, and labor - underscores substantial opportunities for public-private partnerships while highlighting the need for policy development or reform to support industry growth and address challenges. Setting aside the merits or politics of each area, issues such as land permitting reform and workforce adaptation and training emerge as priorities.

There are stark contrasts between the rapid evolution of industry demands and the slower pace of legislative processes. Reconciling these two dynamics will be a recurring theme in our discussion.

.